The telecom Business Support Systems (BSS) market is entering a decisive phase of consolidation.

Large vendors are acquiring adjacent platforms, expanding portfolios, and tightening control over pricing and roadmaps. Recent activity underscores just how quickly this market is shrinking.

In a short span of time, we have seen:

- Amdocs acquiring Matrixx, absorbing a best-of-breed real-time charging innovator

- NEC/Netcracker acquiring CSG in a ~$2.9B deal, creating a massive OSS/BSS powerhouse

Individually, each deal makes strategic sense. Collectively, they signal something much more important:

The independent BSS vendor landscape is shrinking rapidly.

While on paper, this might look like progress.

In reality, many operators are discovering that consolidation delivers scale for vendors, but distance for customers.

For telecom operators, this is not just industry news, it has direct implications for cost, agility, innovation, and long-term strategic control.

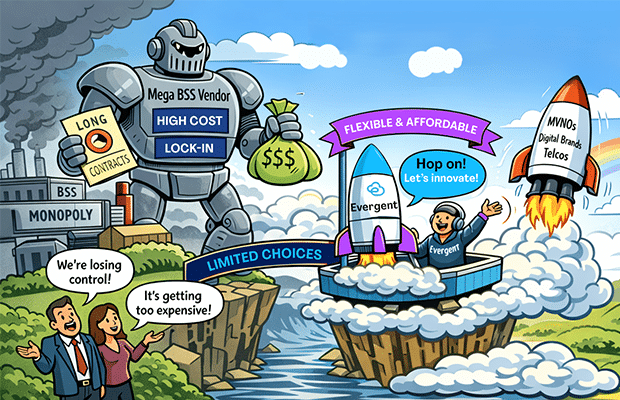

The Telco Impact: Fewer Choices, Higher Costs

Analyst research increasingly flags OSS/BSS consolidation as structurally bad for operators over time. As BTW Media, the global tech media platform, reported last week, “industry observers caution that consolidation can reduce competition and innovation, raising concerns that smaller operators may face fewer options and higher costs in the future.”

Dependency grows when supplier choice narrows. Pricing power shifts to the behemoth vendors. Roadmaps are negotiated internally, not with customers in mind. When large-scale BSS renewals can cost hundreds of millions of dollars, exit becomes impractical, leaving operators effectively captive to someone else’s commercial and product decisions.

While consolidation accelerates, operators are left with fewer credible paths to negotiate, switch, or innovate independently. The consequences are familiar:

- Innovation slows as portfolios are rationalized

- Customers wait while product strategies are reassessed

- Support models become standardized for efficiency, not outcomes

Let’s examine a few of these challenges:

1. Reduced Leverage and Negotiating Power

As niche innovators are absorbed into large platform vendors, telcos are left with fewer credible alternatives. This is especially challenging for:

- Mid-tier operators

- Digital brands

- MVNOs and challengers

2. Rising Total Cost of Ownership

With reduced competition, large vendors gain pricing power:

- Higher license and subscription fees

- Expensive transformation programs

- Long-term, inflexible commercial models

3. Vendor Lock-In Becomes Structural

- Increased switching costs

- Limited architectural freedom

- Slow future modernization efforts

4. Specialist Capabilities are Deprioritized as Platforms are Rationalized

Historically, many breakthroughs in real-time charging, digital monetization, and pricing agility came from specialist vendors. Once absorbed, such innovation at their virtual fingertips tends to align with broader, plodding platform roadmaps. In other words, impactful change now moves slower than market needs.

Meanwhile, Operator Complexity Keeps Rising

At the same time all this is going on, operators remain under pressure to do more than ever:

- Compete aggressively for subscribers

- Support hybrid monetization models across telco, streaming, and digital services

- Launch bundled, multi-partner offerings quickly

- Expand globally with localized payments and compliance

- Reduce churn while improving customer experience

What telcos look for in this market is:

- Modular capability

- Monetization agility

- Cost control

- Freedom to coexist with existing OSS/BSS investments

Recent OSS/BSS research reported by TelecomTV, a leading analyst for the global telecom industry, highlights a telling shift in sentiment: many operators believe cloud-oriented challengers, not incumbent BSS suppliers, are best positioned to deliver future systems. That belief reflects experience, not optimism. It is a direct response to platforms that have grown larger but less responsive.

This is where Evergent plays a uniquely important role.

Where Evergent Fits in a Consolidated BSS Market

Evergent is not trying to out-scale mega-vendors. Instead, our solutions fill the strategic gap created by consolidation.

Consolidation creates a clear opening: operators are scrambling for digital-first, flexible BSS solutions that can sit atop legacy systems, maintain existing operations, and deliver agility for rapid offer launches.

This is precisely where Evergent excels.

1. A Real Alternative to Lock-In

The Evergent Monetization Platform is built using API first architecture principles, It complements large vendors rather than replacing them. This enables choice, flexibility, and architectural independence.

2. Cost Discipline in an Inflated Market

As consolidation drives costs upward, Evergent’s cloud-native SaaS model delivers:

- Lower upfront investment

- Predictable operating expenses (Pay as you Scale)

- Faster deployments measured in months, not years

- Subscriptions and bundles

- Digital services, OTT, IoT, and 5G monetization

3. Speed as a Competitive Advantage

In a market where offers, pricing, and partnerships must evolve quickly, Evergent enables:

- Rapid product launches (In hours, not weeks or months)

- Faster pricing experimentation

- Quicker response to market and regulatory change

Together, these capabilities give operators the flexibility to launch new offers faster, optimize monetization, and scale globally, without being slowed by large, consolidated BSS stacks.

Don’t Surrender to the Reality of the Situation

BSS consolidation is inevitable, so . . .

- Avoid over-dependence on a handful of vendors

- Embrace modular, API-driven architectures

- Balance scale with agility and cost control

The future of monetization is no longer about who controls the largest portfolio.

It’s about who can help operators launch faster, bundle smarter, retain longer, and grow sustainably, across increasingly complex digital ecosystems.

In that future, Evergent’s solutions and strategies are not just relevant.

They are strategically essential.

For operators navigating consolidation today, the priority is clear: preserve choice, protect agility, and ensure your monetization strategy remains firmly in your control - starting here.